Table of Contents

ToggleFactors Influencing Bitcoin’s Price in 2025

Before diving into the price forecast, it’s essential to understand the various factors that impact Bitcoin’s price. These include:

Market Sentiment and Investor Behavior Bitcoin’s price is heavily influenced by the broader market sentiment and investor psychology. Bullish or bearish trends, often fueled by social media, news, and institutional involvement, can drive significant price movements. In particular, large-scale institutional adoption has become a key factor in pushing Bitcoin to higher prices.

Regulation and Legal Frameworks Bitcoin’s price is also shaped by global regulatory developments. Countries that embrace Bitcoin and other cryptocurrencies tend to see higher demand and price increases. On the other hand, stricter regulations, such as bans on cryptocurrency mining or trading, can have a negative impact on prices. In 2025, clearer regulatory frameworks may help stabilize the market and encourage further institutional investment.

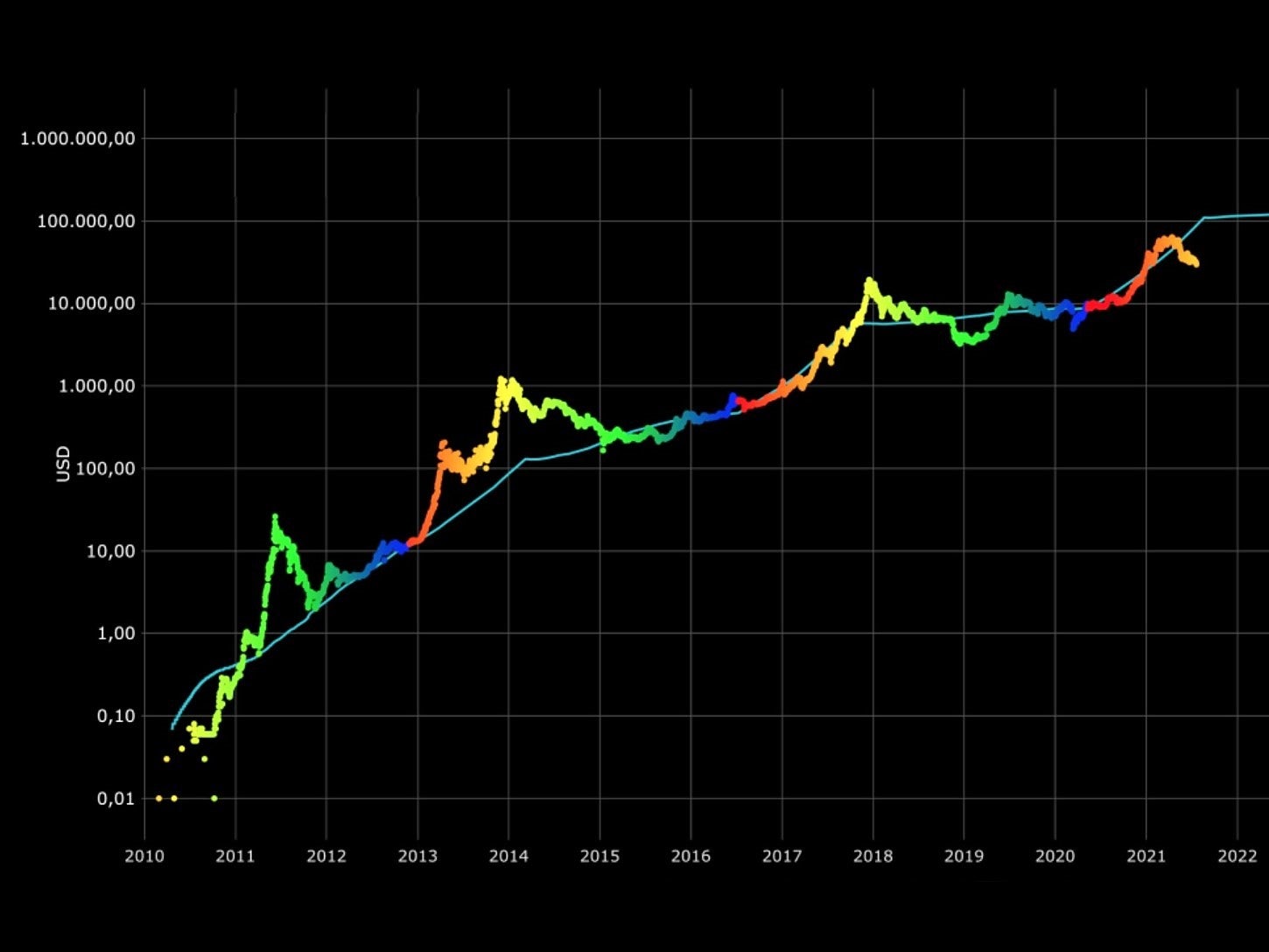

Bitcoin Halving One of the most predictable events in Bitcoin’s lifecycle is the halving, which occurs approximately every four years. During a halving event, the block reward that miners receive for validating transactions is cut in half, reducing the rate at which new Bitcoin is introduced to the market. Historically, crypto-pamphlet.com/ has experienced significant price increases in the months following a halving due to the reduced supply. The next halving is expected to take place in 2028, but its effects may begin to be felt earlier as investors position themselves for the event.

Macroeconomic Factors Bitcoin is often referred to as “digital gold” and is seen by some as a hedge against inflation and economic instability. If traditional financial markets face turmoil, or if inflation rates rise globally, Bitcoin may experience an uptick in demand as a store of value. Conversely, in times of economic stability, Bitcoin may face downward pressure as risk appetite returns to traditional assets.

Technological Developments Bitcoin’s underlying blockchain technology continues to evolve. Innovations such as the Lightning Network, which enables faster and cheaper Bitcoin transactions, could improve Bitcoin’s usability and increase demand. Additionally, the general adoption of Bitcoin by businesses as a payment method could push the price higher.

Global Economic Trends Global economic conditions, such as changes in interest rates, government fiscal policies, and the overall health of the economy, also affect Bitcoin. For example, the announcement of interest rate hikes by central banks can lead to a flight of capital from risky assets like Bitcoin into safer havens, leading to price declines.

Bitcoin Price Forecast for 2025

While Bitcoin’s price is difficult to predict with absolute certainty, analysts and market experts can provide forecasts based on the factors outlined above. Here are some key predictions for Bitcoin’s price in 2025:

Optimistic Forecast: $150,000 – $200,000

Some bullish analysts predict that Bitcoin could reach a price range of $150,000 to $200,000 by the end of 2025. This forecast is supported by the following factors:

Continued Institutional Adoption: More institutional players are expected to enter the market, increasing demand and supporting higher prices. Major financial institutions, hedge funds, and corporations are likely to continue integrating Bitcoin into their portfolios and balance sheets.

Global Economic Uncertainty: As central banks may struggle to contain inflation and manage economic uncertainty, Bitcoin’s appeal as a store of value could increase, leading to higher demand.

Bitcoin’s Scarcity: With a capped supply of 21 million BTC, Bitcoin’s scarcity may drive the price higher, especially as demand increases and supply growth slows due to halvings.

Moderate Forecast: $80,000 – $120,000

A more conservative price prediction for Bitcoin places its value between $80,000 and $120,000 by the end of 2025. This outlook is based on a balanced assessment of market conditions:

Regulatory Clarity: If regulatory clarity increases in major markets like the U.S., Europe, and Asia, Bitcoin could see stable price growth, but not necessarily at the extreme levels seen in past bull runs.

Gradual Institutional Adoption: While institutional adoption will likely continue, it may not increase at the pace necessary to propel Bitcoin to astronomical heights. This could result in slower, more gradual price appreciation.

Economic Stabilization: If global economic conditions stabilize, Bitcoin may not see the massive price jumps associated with times of crisis or inflation fears. Instead, the market may become more stable, leading to modest growth.

Pessimistic Forecast: $40,000 – $60,000

On the other hand, a more bearish outlook suggests that Bitcoin could trade between $40,000 and $60,000 in 2025. This scenario could occur if the following happens:

Regulatory Crackdowns: If governments around the world impose harsh regulations or outright bans on Bitcoin, it could severely impact the market, leading to price declines. China’s past crackdowns on crypto mining and trading have shown how government intervention can affect the price.

Global Economic Recovery: If the global economy recovers and inflation fears subside, investors may shift their capital back into traditional assets like stocks and bonds. This could result in reduced demand for Bitcoin, causing its price to stagnate or decline.

Competition from Other Cryptocurrencies: The rise of competing cryptocurrencies, especially Ethereum and Layer-2 scaling solutions, could divert interest and capital away from Bitcoin. While Bitcoin remains the leader, increased competition could limit its growth potential.

Factors That Could Drive Bitcoin’s Price Higher in 2025

Widespread Adoption of Bitcoin as a Payment Method: If more companies and consumers begin to use Bitcoin for payments and remittances, this could drive up its value due to increased demand and network usage.

Growing Interest from Retail Investors: If more retail investors enter the market, particularly with the rise of easy-to-use platforms and applications, Bitcoin could see a boost in demand and price.

Halving Speculation: As Bitcoin’s next halving approaches in 2028, investors may begin accumulating Bitcoin earlier in anticipation of reduced supply and future price increases.

Conclusion: Is Bitcoin a Good Investment in 2025?

Bitcoin remains one of the most exciting and volatile assets in the world. While it’s difficult to pinpoint its exact price in 2025, it’s clear that Bitcoin’s growth trajectory is influenced by a range of factors, including institutional adoption, regulatory developments, and broader economic trends.

For those interested in investing in Bitcoin, it’s crucial to approach the market with caution and a clear understanding of its risks. Bitcoin can be a powerful store of value and hedge against economic instability, but it also comes with the potential for significant price swings.

Ultimately, the future of Bitcoin looks promising, but its price forecast will depend on how the market, regulators, and technology evolve in the coming years. As always, conduct thorough research and consult with financial advisors before making investment decisions.